Developing

and full lifecycle testing of lending system to individuals

TASKS

- Developing a system for automation of lending system to individuals.

- Developing the functionality for open amounts calculation, documents generation, reports, assessments, accounting records. Creating the reporting system of cash flow.

- Realization of automatic notifications subsystem.

- Organization of user roles segmentation.

- Entire quality assurance of the product developed from scratch.

- Ensuring confidentiality of personal and financial data.

- Ensuring a stable work of application client end considering all possible ways of Internet connection including 2G/3G.

TESTS TYPES

Functional testing

Regression testing

Cross-browser testing

Performance testing

Security testing

WORK TECHNIQUES

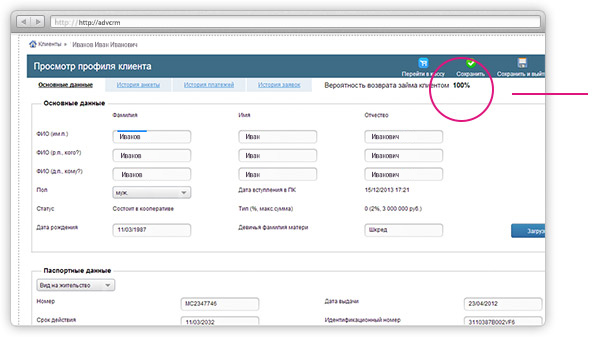

1. Operator enters all the personal data

under the fields required.

under the fields required.

2. The entered data are processed separately for

every client resulted in persentage calculation of

paying back probability. Then the operator makes a

decision on loan issuing.

every client resulted in persentage calculation of

paying back probability. Then the operator makes a

decision on loan issuing.

Every client data is entered under application form,

required data are considered for statistics reports.

required data are considered for statistics reports.

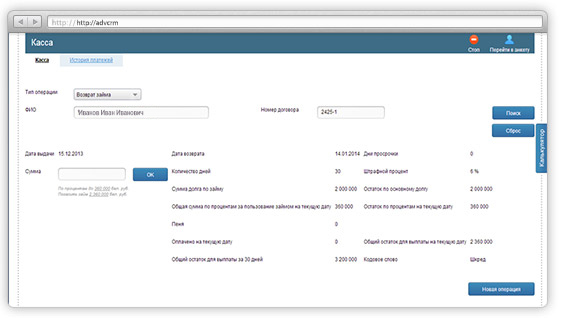

3. The loan payments are performed by cashier.

All the transfers are reported in the system and

renewed automatically.

All the transfers are reported in the system and

renewed automatically.

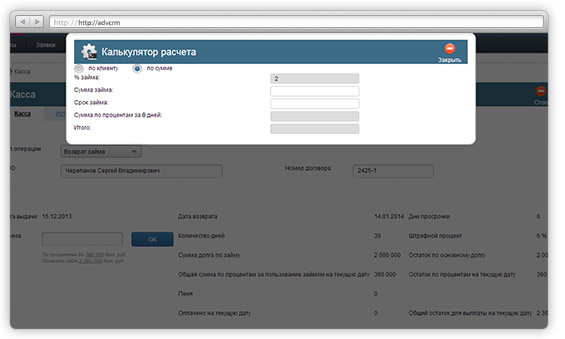

4. Using the calculator provided by the system, the

operator has the option to calculate the final sum

required for loan issuing.

operator has the option to calculate the final sum

required for loan issuing.

The operator has the option to calculate the final loan amount by means of calculator

5. All the transfers of loan repayment are reported to

the system any time avalaible for the operator’s

review

the system any time avalaible for the operator’s

review

The operator possess all the information

on a client’s loan

on a client’s loan

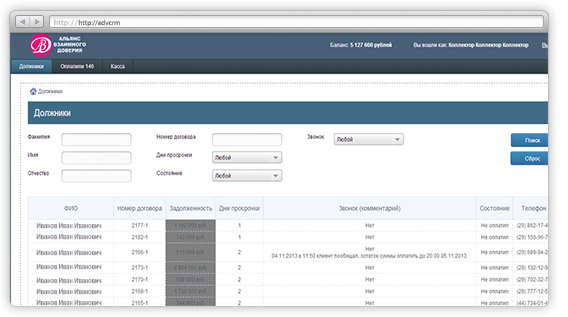

6. The system also provides the functionaly of Collector

for obligators monitoring. "The Collector has the option to see all the repayments

or not repaymenrs and days of their arrears. Also, there is an option to follow the repayments status

and sending the documetns to the judicial institutions.

The forming of all document is perfomed automatically.

for obligators monitoring. "The Collector has the option to see all the repayments

or not repaymenrs and days of their arrears. Also, there is an option to follow the repayments status

and sending the documetns to the judicial institutions.

The forming of all document is perfomed automatically.

Collector monitors repayments status and send the documents to judicial institutions

7. System Administrator has all the operator’s

rights and all the functionality for entire system

managing (history review, additional options).

rights and all the functionality for entire system

managing (history review, additional options).

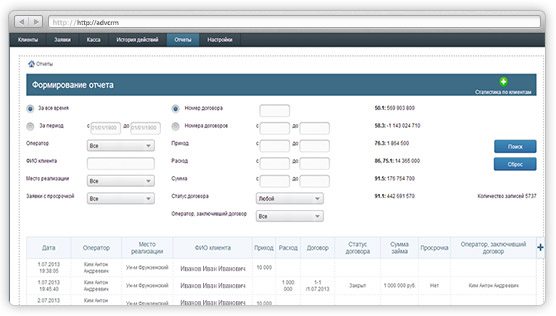

8. Administrator has the access to reports

for all the operations in the system. The reports are to be formed

under selected parameters.

for all the operations in the system. The reports are to be formed

under selected parameters.

Administrator selects the reports

under the results required

under the results required

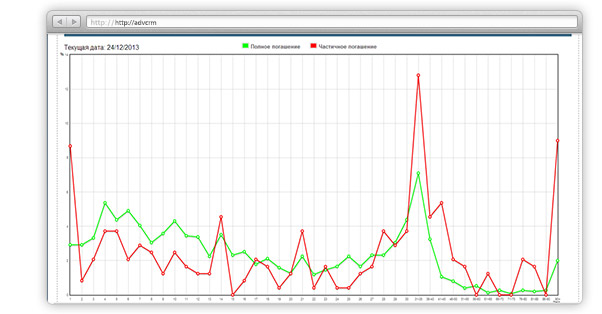

9. The system has the option to see

the repayments statistics both

on payment days and posibility

of open amounts cases.

the repayments statistics both

on payment days and posibility

of open amounts cases.

Administrator monitors the statistics

by days of clients’ repayments

by days of clients’ repayments

10. As a result, the system enables automatically process the loans (issuing, payments, storing and editing all the clinents data).

Administrator has the option to monitor

all the alterations and analyze the information on all operations.

Administrator has the option to monitor

all the alterations and analyze the information on all operations.

Technologies and instruments

- Issue tracking system: Atlassian Jira,

deployed on Webmartsoft server. - Web-site management: Webmart CMS.

- • Development technologies: Symfony 2, PHP 5.3, MySQL 5.1.6.7,

Doctrine 2, Twig, MVC, JQuery, Ajax, Сron, Apache 2.2. . - Connection speed emulation NetLimiter 4.

- Check of calculation functionality speed depending

on calendar changes on the server: VMWare Workstation 9.0. - Load testing: SilkPerformer 10.0.

- Security standard: OWASP.

- Security scanners: Acunetix Web Vulnerability Scanner 8.

- Automatic detection of broken links:

Xenu’s Link Checker. - Usability Standards: ISO 9241, ISO 13407, ISO 18529, ISO 16982

Results

Within a week active

operators started using

the system and began

loan applications

processing.

At present, new operators registration

and adaptation to the system

is performed

for several hours.

operators started using

the system and began

loan applications

processing.

At present, new operators registration

and adaptation to the system

is performed

for several hours.

Production release

of the product was created

for 3 months.

of the product was created

for 3 months.

There were no any cases

of users’ data abuse

although security

attacks took place.

of users’ data abuse

although security

attacks took place.

The product operates

in 3 offices for 10 operators

using various computer

паtypes and Internet

connections.

in 3 offices for 10 operators

using various computer

паtypes and Internet

connections.

7 stages of reworks were performed for 5

months, including changes in

interest rate calculations

algorithms for new clients. Total

working hours for testers

are more than 500 man/hours.

months, including changes in

interest rate calculations

algorithms for new clients. Total

working hours for testers

are more than 500 man/hours.

Interaction method: Time & Material